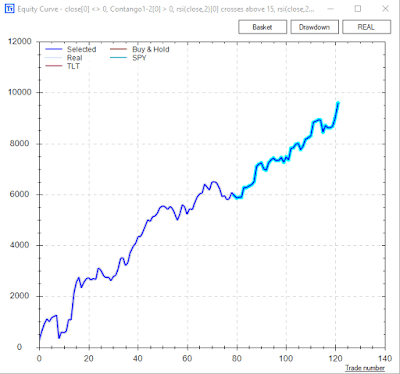

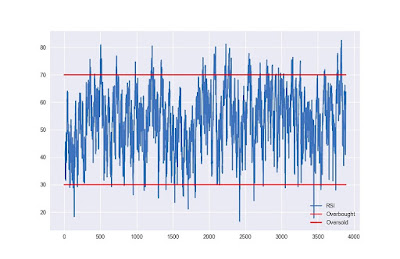

This is a simple technique that can increase returns per dollar traded. This blog will show an example of a simple strategy to demonstrate the advantages of Rebalance strategies. The base strategy is quite simple and uses all built-in signals inside of BuildAlpha : Entries: RSI2 crosses above 15 and 20 Vix term structure is positive (front two months, contango) Exit: RSI2 crosses below 95 $1,000 stop loss (all positions based on $10,000 at time of entry) The way the Rebalance strategy/filter works is that we first set the rebalance period. Choices are: daily, weekly, monthly, quarterly, and annually. We will use monthly in this example. We then set the ranking method. Choices are: Profit Factor, Winning Percentage, Average Return, Volatility, Sharpe Ratio, Range Location, Rate of Change, Momentum, and Fip Score (% return * [neg% days – %pos days]). We will use winning percentage in this example. At the end of each rebalance period, we r...