Rebalance Strategies

This is a simple technique that can

increase returns per dollar traded. This blog will show an example of a

simple strategy to demonstrate the advantages of Rebalance strategies.

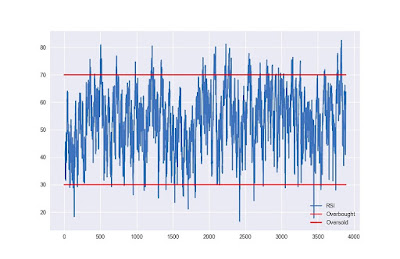

The base strategy is quite simple and uses all built-in signals inside of BuildAlpha:

Entries:

- RSI2 crosses above 15 and 20

- Vix term structure is positive (front two months, contango)

- RSI2 crosses below 95

- $1,000 stop loss (all positions based on $10,000 at time of entry)

The way the Rebalance strategy/filter

works is that we first set the rebalance period. Choices are: daily,

weekly, monthly, quarterly, and annually. We will use monthly in this

example.

We then set the ranking method. Choices

are: Profit Factor, Winning Percentage, Average Return, Volatility,

Sharpe Ratio, Range Location, Rate of Change, Momentum, and Fip Score (%

return * [neg% days – %pos days]). We will use winning percentage in

this example.

At

the end of each rebalance period, we rank our symbol universe based on

the ranking method and then apply our base strategy to ONLY the top (or

bottom) N symbols. We will use a symbol universe of only SPY and TLT in

this example.

Also, we will rank SPY and TLT each month

based on their winning percentage in the prior month and then apply our

simple base RSI2 strategy to ONLY the higher ranked symbol for the next

month.

If the same symbol is ranked higher

(i.e., permitted to trade) for consecutive months then we would

calculate the new position size for the new month and then rebalance the

existing position. Hence, the name Rebalance strategies.

For example, if long 1,237 shares of SPY

in May, and at the end of May we determine our June symbol is SPY, and

our new size should only be 1,200, it would automatically sell 37

shares.

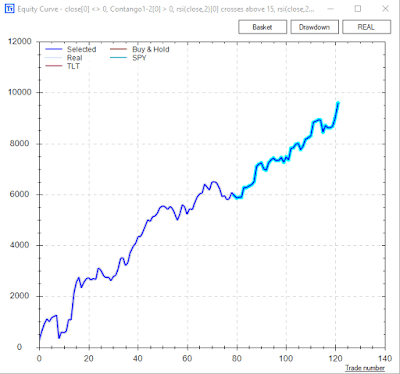

Comparing the results of applying the

base RSI2 strategy on both SPY and TLT to the results of applying the

base RSI2 strategy on SPY and TLT with the rebalance filter shows

significant positive improvement while decreasing the capital at risk

while using the rebalance filter. Kind of a big deal!

On the left, you can see if we ‘blindly’

applied the base RSI2 strategy to both SPY and TLT each month. That is,

each would have its own $10,000 position each month. The right shows the

same RSI2 strategy but only applied to the top ranked symbol based on

the previous month or a single $10,000 position.

You can see the rebalance filter and

symbol universe ranking provided equal returns while limiting exposure

from 2007 to present day.

Again, this is not meant as a standalone

strategy or a free alpha giveaway… but a simple example to demonstrate

the need to turn over every stone in our testing to uncover alternative

ways to reduce risk and exposure. If you are not checking if rebalance

filters and cross-sectional momentum can improve your returns… then why

not?

In short, the trader can select a basket

of symbols, rebalance period, and ranking method then thousands of entry

and exit signals. Build Alpha will automatically find the best base

strategy to apply to the top (or bottom) N symbols in the selected

basket based upon your input.

Of course, all output, including the

symbol ranking and rebalancing, can be automated in TradeStation through

the code generated from Build Alpha.

I hope this helps demonstrate the power

of rebalance strategies and filtering the symbol universe. It is just

another arrow in the quiver for savvy systematic traders. If you have

any questions, please contact me at david@buildalpha.com. Thanks for

reading.

Comments

Post a Comment