Free Friday 9 – Intermarket Signals

In this week’s

Free Friday strategy (#9) I display a strategy built using inter-market

signals. Inter-market signals/analysis is the ability to generate

trading signals and filters for a primary market based on what another

market may be doing.

For example,

you may only want to buy the stock market when gold is trading lower or

when bonds are below their 200 simple moving average.

Build Alpha

now let’s you test these exact sort of scenarios and build strategies

taking into account up to 3 markets (plus Vix). This specific strategy

was built for SPY (S&P500 ETF) but takes into account Gold (GLD ETF)

and holds for a maximum of 2 days.

There are no

other exit rules or sophisticated risk management; all trades assume

only a 100 share position for testing purposes.

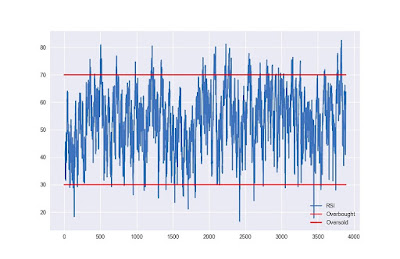

The entry:

1. $SPY’s 2-period RSI <= 90

2. Gold’s 50 period simple moving average is greater than Gold’s 200 period simple moving average

3. Gold closed below both its 10 period simple moving average and its 50 period simple moving average

2. Gold’s 50 period simple moving average is greater than Gold’s 200 period simple moving average

3. Gold closed below both its 10 period simple moving average and its 50 period simple moving average

The exit:

Exit after holding for 2 days

Originally Posted: https://www.buildalpha.com/free-friday-9-intermarket-signals/

Comments

Post a Comment