Combining Trading Rules To Smooth Performance

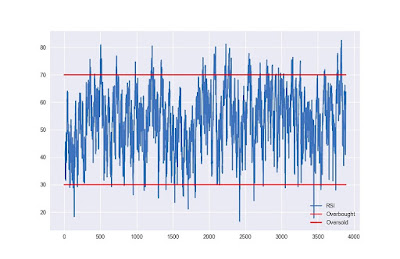

The market is “overbought” or “oversold” are common phrases you will hear across the finance space. However, it is actually extremely rare for these conditions to be true. Today, we’ll attempt to show how trading rules can provide a better picture of the market while enhancing trading performance. BuildAlpha : First, let’s simply define overbought as a 14 period RSI of greater or equal to 70.00 and let’s simply define oversold as a 14 period RSI of less than or equal to 30.00. Below is a chart showing the RSI of the S&P 500’s ETF (NYSEARCA:SPY) with the overbought and oversold levels plotted. From January 2002 to May 2017 here are some stats: Days overbought 214 out of 3,878 or only 5.5% Days oversold 60 out of 3,878 or only 1.5% Days in the middle roughly 3,604 out of 3,878 or 92.9% Of course when these overbought or oversold conditions are true the markets do appear easier to trade as volatility often expands and it seems easier to skim some m...