Utilize Automated Trading Software to Increase Trading Edge

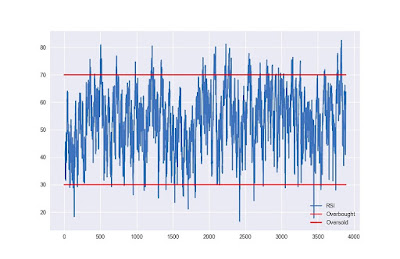

Have you ever thought about how you can automate your trading strategies and increase your edge? Yes or No? Here, you will get to know the basics of algorithmic trading, the benefits, and the risks. Get ready to utilize automated trading software like Build Alpha. A lot of technical analysis involves surveillance pointers for signals and then trading based on the signals.

What if you could program a computer to mechanically and automatically recognize these setups and enter trades automatically? Isn’t it good if you free yourself from giving trading instructions to the system continuously? Yes, this is possible.

Computers are much better than human at doing the math. If an individual can recognize setups that make you the most capital, so can a computer. In fact, computers are quicker and more accurate than a human being at solving math problems. So, why not to tell the machine what the norms of the game are and let it trade for you. These days, much automated software like BuildAlpha available in the market that can find the best strategies for you. Let’s get to know about the algorithms and their benefits.

What is an algorithm and how they are used in trading?

“Algorithm is a set of norms to be followed in calculations and problem-solving operations by a computer”. That appears very similar to a technical trading strategy. You discover a setup that works for you and then decide what to do about it. It’s just a simple example.

If you identify the circumstances where to open a position or where to close, then you can tell the machine to do a similar thing. This means the trading process will be faster and accurate.

The edge can be clearer if we take a look at a more advanced example. Let’s assume you want to combine 5 indicators and examine a basket of 7 different assets for trade entry. It’s a really huge amount of information that the human mind has to manage.

You have to switch back and forth the screens appear for the indicators to twist to green that indicating you to get into the market. Here the probability of making an error is amplified as your concentration is split over numerous markets. This is where the need for automated trading comes into the play. Not to mention all the emotion that comes with manual trading.

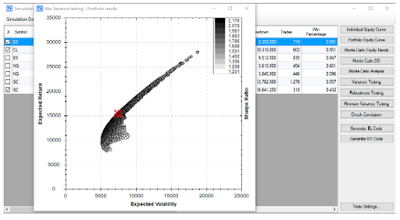

Automated trading software such as Build Alpha allows machines to make verdicts and act on them much faster than a human being can and all backed by data. The automated software is the perfect solution to observe one-minute charts all the way to daily and weekly charts in trading and take appropriate action as soon as the market shows signs of making a shift. In fact, the automated system can be used to inexpensively scale your operation. Hence, it is advisable to use automated trading software if you want to increase your edge from your trading. It can help spot new edges, capture existing edge and all automatically.

Originally Posted: https://buildalpha.wordpress.com/2019/09/23/utilize-automated-trading-software-to-increase-trading-edge/

Comments

Post a Comment