Randomized Out of Sample

First, what is out of sample testing? Out

of sample testing is purposely withholding data from your data set for

later testing. For example, let’s say we have ten years worth of data

and select to designate the last 30% of the data as out of sample data.

Essentially what we do is take the last 3 years (30%) of the data set

and put it in our back pocket for later use. We then proceed to create

trading strategies using ONLY the first 7 years of data or the

“in-sample” data.

BuildAlpha:

Let’s assume we find a great looking strategy that performs extremely

well on the first 7 years worth of data. What we would then do is take

the last 3 years worth of data, or our out of sample data, out of our

back pocket and proceed to test our strategy on this “unseen” data.

The idea is… if the strategy still

performs well on this unseen, out of sample data then it must be robust

and we can have increased confidence it will stand the test of time or

at least in how it will perform on future market data.

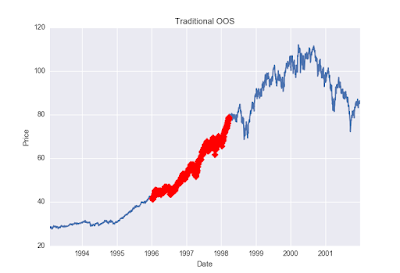

However, there is a major pitfall to this

approach given certain data sets. What if our amazing looking strategy

happened to be long only and only performed well on our unseen, out of

sample data because the last 3 years (our 30%) were extremely bullish.

See picture below (red marks last 30% of data):

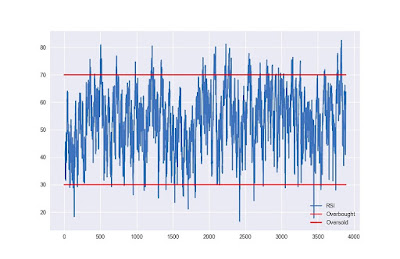

What’s a solution? What if we use the

first 30% of the data instead of the last 30%? What if we use some

middle 30% of the data? Well, we actually still run the risk that any

continuous 30% of the data may be extremely trendy. Here is a photo

showing a strong trend in the beginning 30% of a data set.

The answer? Let’s take our original

backtest results and run them through a randomized out of sample test.

First we randomly select dates until we have randomly selected 30% of

the dates from our data. Now we have a “randomized out of sample” period

to put in our back pocket. Basically, we will then run through our

entire data set but filter out any trades that would have occurred on

our now randomly selected, out of sample dates.

Then we can view the results of the

trades that only took place on our randomly selected out of sample dates

as a new “quasi-out of sample” equity curve. We’ve now significantly

reduced the chances that any successful out of sample performance is

solely due to some underlying trend or market regime as our out of

sample data is now no longer continuous. Here is an example of random

30% of data selected for out of sample.

However, one more problem remains. What

if we randomly created a trend or favorable market regime through our

random sampling/selection? That is, we’ve randomly selected 30% of the

dates and when they’re put in chronological order for our out of sample

testing they coincidentally create a massive up trend that could skew

our new out of sample results?

The answer? Run this test 1,000 times

where we re-select a random 30% of the dates each time to act as our out

of sample period. Some may create a favorable market regime, but we can

see how our sample strategy does over a variety of randomly created

regimes or out of sample periods.

Build Alpha Solution:

BuildAlpha

offers this complete process and test with the click of a button. The

leftmost graph below is the in-sample equity curves from the 1,000 runs.

These are basically trades that occurred on dates that were NOT

randomly selected to be part of the out of sample period. The middle

chart is our randomized out of sample test. These are the equity curves

from the 1,000 runs of the trades that occurred on the dates that were

randomly selected. The thick blue line on the left and middle graph are

the in and out of sample tests from our original back-test. The

rightmost chart is simply the original back-test.

The example below shows our original

backtest’s out of sample equity curve to be at the very top of the

distribution of all the random out of sample tests (middle chart below).

This is a sign that the underlying data contributed quite favorably to

our results and may have produced unrealistic or unrepeatable out of

sample results (most likely something like the first picture of this

post where the last 30% of the data is considerably bullish).

In the picture below I’ve displayed a

simple demonstration that would show a “passing” random out of sample

test or a situation where you can feel comfortable the original out of

sample period is a “fair” period of time. The middle graph’s thick blue

line (our original out of sample results) is in the middle of the random

out of sample distribution. This means as we randomly selected random

out of sample periods we created some out of sample equity curves that

had better results than our original backtest and some that had worse

results than our original backtest. This can only mean that our original

out of sample period was “fair” and did not overly contribute to the

favorable results, but rather the favorable results come from the

strategy itself.

Some Takeaways:

We know we want to test on “unseen” data,

but also want to reduce the chances that an underlying trend produced

favorable out of sample results. In order to avoid being fooled by a

favorable out of sample period, we randomly create thousands of out of

sample periods and want to see general profitability across them all.

If the original backtest’s out of sample

line is significantly greater than all the randomized out of sample

equity curves then we can conclude we had originally selected an overly

optimistic out of sample period that contributed too greatly to our

strategy’s out of sample success (similar to the first photo in this

post).

Additionally, if our original backtest’s

out of sample line is one of the worst performers compared with the

randomized out of sample equity curves then we can conclude the original

out of sample period chosen may actually be too unfavorable (and

throwing the strategy away based on out of sample results alone may be

ill-advised).

All in all, Randomized Out of Sample testing is just one more test Build Alpha offers to provide the utmost confidence a strategy will perform to expectation moving forward.

Originally Posted: https://www.buildalpha.com/randomized-out-of-sample/

Comments

Post a Comment